Depression and Senior Citizens: What You Need to Know Part 2

Depression is a serious illness that affects a growing number of Americans, including seniors. The good news is that depression can be managed with the proper care. In the first half of this series, we talked about some of the contributing factors for depression. We also talked common indications that you might need to reach […]

Depression and Senior Citizens: What You Need to Know Part 1

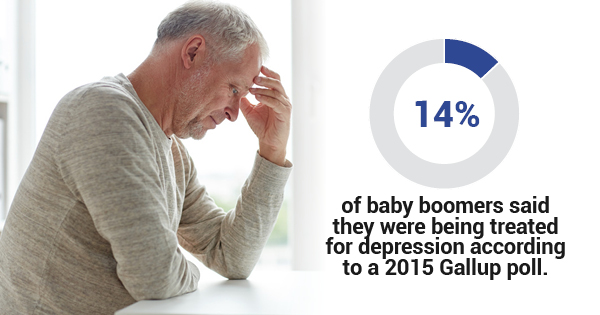

Not all ailments are physical. In fact, 14% of baby boomers — or one in seven — said they were being treated for depression according to a 2015 Gallup poll. That rate is higher than any other generation of American adults. Oftentimes, those suffering from non-physical illnesses are uncomfortable talking about their struggle, which might […]

Preventive Health Care on Medicare Part 4: For African Americans and LGBTQIA

Medicare is an insurance program available to all Americans who have worked for at least ten years and have reached the age of 65. The service covers a wide range of medical needs, ranging from emergency services to preventive health services, costing a total of $597.2 billion according to the Congressional Budget Office. In recent […]

Preventive Health Care on Medicare Part 3: For Women

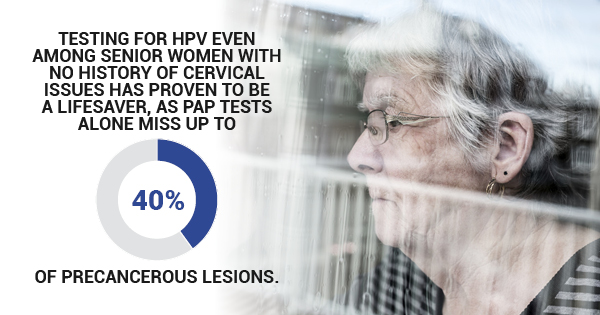

In this four-part series, we are examining the ways preventative health care and services can help catch illnesses early while they’re still treatable, and the way Medicare health insurance plans can help with managing health care expenses. So far, we’ve delved into Medicare Plan B’s Coverage and the most important types of preventive screening for […]

Preventive Health Care on Medicare Part 1

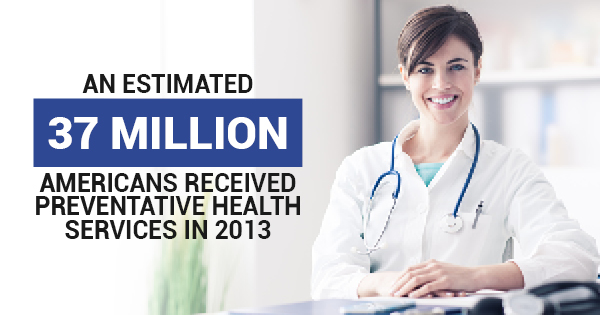

There are a number of ways for seniors to avoid getting sick: eating well, exercising, avoiding smoking and excessive drinking. Unfortunately, these steps are not always enough to keep you from experiencing one of any number of ailments common in people over 65. That is why preventive health services are so vitally important for seniors. […]

Research Tips for Choosing Health Insurance

Health insurance is one of the most important things that you can have. The ability to receive medical care at an affordable rate is a key aspect of society and living in the modern world. Doctor visits are expensive. Often, insurance can save you a lot of money on health care expenses, especially if those […]

Don’t Underestimate the Importance of Insurance Policies

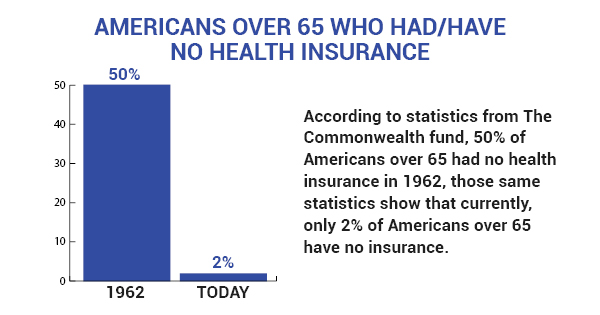

Sadly, far too many people in the U.S. take insurance policies for granted. These people either ignore their policies, agree to whichever one is first offered to them without doing any research, or, in the worst circumstances, completely disregard the need for insurance policies. Over the next few decades, there’s going to be a significant […]

Medigap Misconceptions: Setting the Record Straight

Understandably, seniors often have a lot of questions concerning their medical insurance options. There are so many plans to choose from that it’s hard to know which will be right for you. Most seniors will find that they require a combination of a few different plans to ensure full coverage. Some folks find that Medicare […]

Should You Purchase Life Insurance if You Are in Debt?

If you are currently facing student loans, a high mortgage, car loans, or other forms of debt, purchasing life insurance is likely the last thing on your mind. By neglecting to face this important life step, however, you are setting yourself and your loved ones up for more complicated financial realities in the future. As […]

5 Health Problems That Might Increase Your Life Insurance Rates

When calculating your life insurance premium, underwriters will take your overall health into account. This risk assessment includes the majority of older people in the United States. According to 2014 data from The Commonwealth Fund, 87% of Americans had at least one chronic illness, while 68% had two or more. The prevalence of conditions such […]