5 Questions To Ask When Shopping for Life Insurance

Life insurance is an important step in preparing to care for your family in the event that you pass away unexpectedly, but it’s completely normal to have questions. In fact, it’s encouraged. Approximately 86% of surveyed individuals reported that they believe most people require some amount of life insurance, but they may not know what […]

5 Things You Should Know About Diabetes

In the U.S., one-third of adults have pre-diabetes, and the majority of them aren’t even aware of it. Because diabetes is such a problem in the U.S., it’s essential for patients to have affordable term life insurance plans and all the essential health benefits that you’ll need. Here are some of the important aspects […]

No Health Insurance? Expect to Pay a Fine This Tax Season

Tax season is underway, and while some Americans are looking forward to a nice refund, others are dreading the day they get slammed with penalties and additional payments. And if you didn’t sign up for health insurance last year, you may be kicking yourself. In 2015, the uninsured rate among working-age adults was 13%, […]

How Does Suicide Affect a Life Insurance Policy?

A loved one’s suicide can be one of the most painful situations to face. With all the questions and uncertainties that come with such a terrible loss, the last thing you need is to worry about the future because of a denied life insurance claim. Unfortunately, there are a number of factors that affect how […]

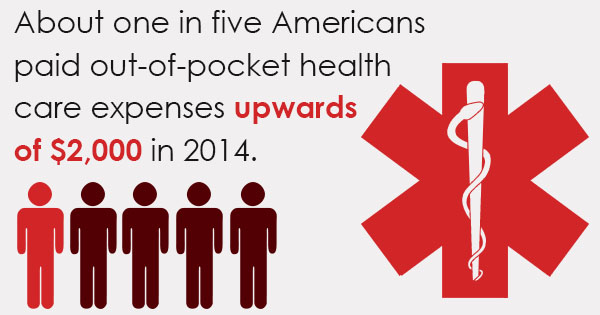

4 Simple Ways to Manage Your Health Care Expenses

Even if you live an extremely healthy lifestyle, you may still have to visit the doctor once or twice a year. Most people seek medical help more frequently than that, though, and those costs can add up quickly. According to The Commonwealth Fund, about one in five Americans paid out-of-pocket health care expenses upwards of […]

4 Common Life Insurance Mistakes to Avoid

We all want to be able to plan ahead and provide for our families after we pass on. Many people choose to do so through life insurance coverage. However, with laws and circumstances changing all the time, sifting through all the different types of life insurance policies can be a complex and overwhelming process. In […]

Purchasing Life Insurance for Those Over 60

Although many people consider a life insurance policy to be necessary only when they have a family for whom to provide, having one can actually be vital in a number of different situations. Even if your children are all grown up and your mortgage is all paid off, you may find that having life insurance […]

5 Reasons Single People Need Life Insurance, Too

In a recent survey, 86% of respondents agreed that most people require some amount of life insurance coverage. But as a single person with no dependents, does that really apply to you? The answer, which may surprise you, is yes. Here’s why: You have debt Guess what? Not all debt dies with you. Loans from […]

Increased Coordination: A Medicare Experiment

Over the last eight years, there has been a concerted effort to reinvent Medicare. The direction the program is currently being steered towards is focused on increasing quality through a coordinated effort. With a new President poised to begin his term, there are definitely some questions facing the country right now, but Medicare seems to […]

Medicare Advantage vs. Medigap – What’s the difference?

Besides being the textbook definition of senior citizenry, turning 65 years old comes with something that everyone is entitled to: Medicare eligibility. For nearly 50 years, seniors and people in their retirement years have been able to get much of their health expenses covered through the Medicare program. The one thing that many people often […]